Daily Market View: No Surprises From Powell & Co.

1-Minute Market Rundown

- The Fed hiked by 75bps last night, as expected, while signalling a move to a more data-dependent stance, ditching forward guidance

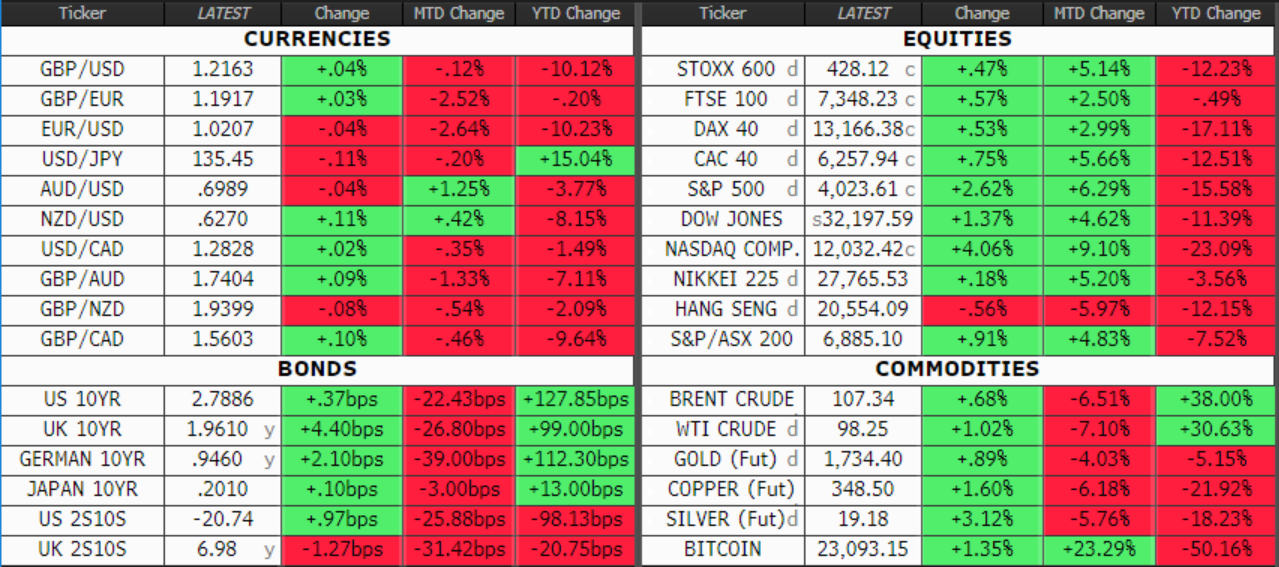

- Equities took this latter shift as dovish, as did the dollar, which softened a touch, though both moves look rather spurious

- Looking ahead, the latest US GDP report highlights today’s calendar, as market participants wait for summer to begin

No Surprises From Powell & Co.

That’s the Fed done & dusted for summer, then – I’d expect most of the rest of the market will follow suit in heading for the beach relatively shortly.

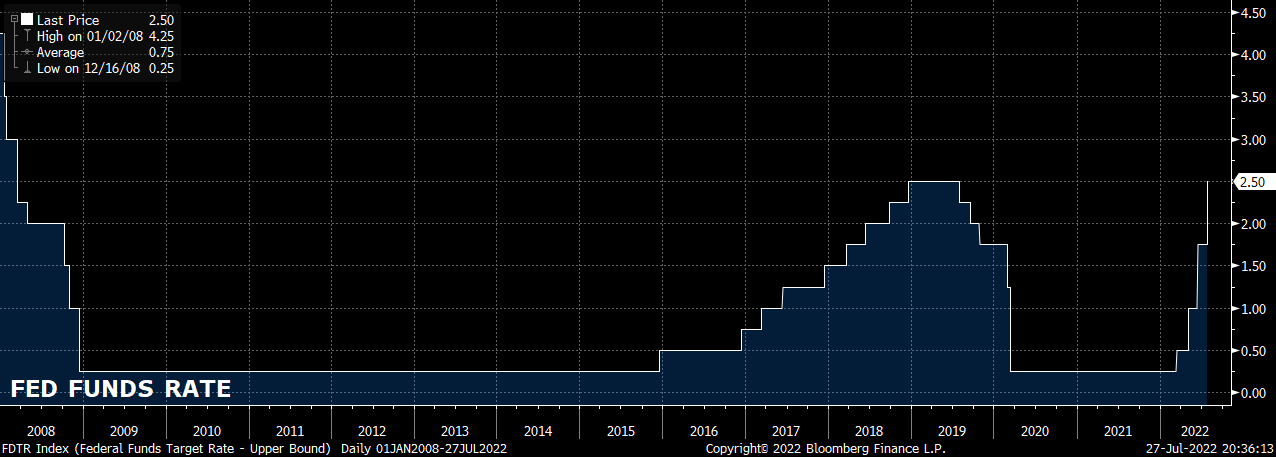

Powell & Co. sprang no surprises last night, plumping for a second straight 75bps hike, while opening the door to smaller moves from the next meeting onwards, as policy moves into restrictive territory. Perhaps the only interesting thing about this is that rates now sit at their joint-highest since the financial crisis – the era of ‘easy money’ is, definitively, at an end.

One thing that was notable, perhaps the only thing, is that forward guidance is now officially dead; the ECB put one nail in the coffin last week, with Chair Powell hammering in the final nail last night.

The Fed will now offer ‘less clear guidance’ on future rate moves, instead assessing the appropriate course of action on a meeting-by-meeting basis, depending on incoming data. Arguably, this is how monetary policy decisions should always be made; perhaps we wouldn’t be in the current mess if the whole forward guidance experiment never took place.

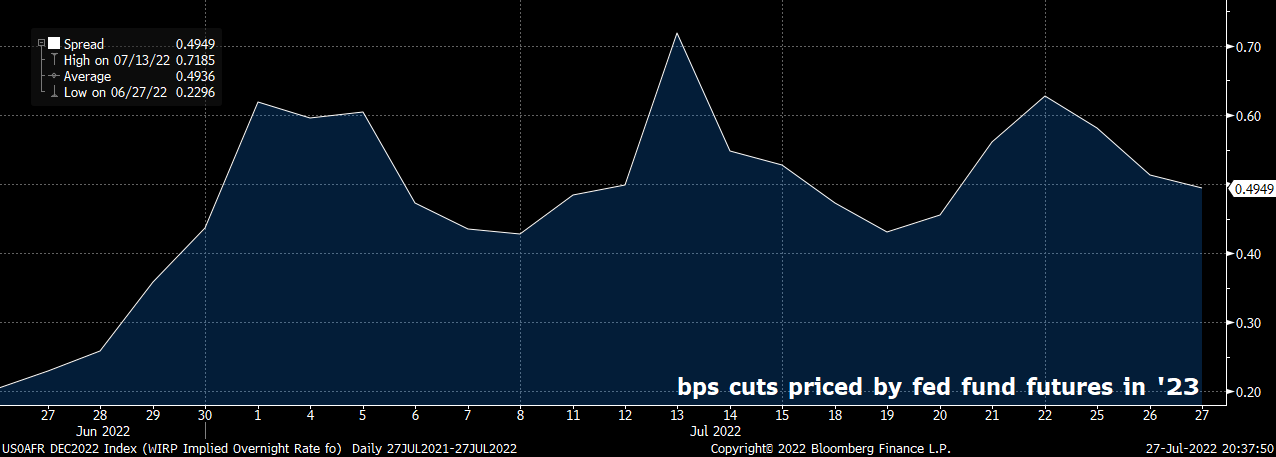

Anyway, the market still prices a chunky amount of rate cuts next year, despite Powell again noting how he “doesn’t think we’re going to have a recession”. Both can’t be right; let’s say that the market is seldom wrong.

Stocks, though, liked the new meeting-by-meeting approach, presumably thinking that this may lead to a more dovish policy approach.

I believe that this line of thinking is wrong, however. The Fed remain squarely focused on taming inflation, despite flagging economic growth, and are unlikely to make any sort of dovish pivot, any time soon, given CPI continuing to print 4-decade highs. While the S&P managed to break north of 4,000 yesterday, I still favour playing things from the short side.

The rally in equities, coupled with front end Treasury yields slipping by almost 10bps, saw the dollar roll-over, taking the DXY south of 107. Again, this isn’t a move that I’d expect to last especially long; the Fed is still hawkish, and global growth remains dismal, slowing more rapidly than expected.

There’s not much other than the greenback that I’d be wanting to own in that environment. Hence, cable’s rally into the 1.21s, and the EUR’s foray back above 1.02, both look like moves worth fading.

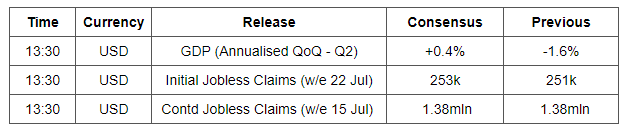

With the Fed out of the way, markets are quite likely to settle into something of a summer slump relatively soon. The latest US GDP report is due this lunchtime, though I struggle to get especially excited about such a lagging release.

Today's Economic Calendar

Markets This Morning (at 6am, London time)

I'd love to hear your comments, questions or suggestions. You can reach me on email at michael.brown@caxtonfx.com.

About the Author

Michael Brown is Head of Market Intelligence at Caxton, leading Caxton’s analysis, forecasting, and thought leadership within all areas of financial markets. He provides regular cross-asset market commentary and analysis, along with insight on market-moving macroeconomic events, being regularly quoted in national and international media. In addition, Michael leads on the inclusion and implementation of market research into Caxton’s data-led sales and marketing process. Away from Caxton, Michael is currently pursuing an Executive MBA at Cranfield University.