Caxton | Daily Market View

USD Points Lower Following Jobs Report, Inflation to Follow on Thursday

1 Minute Market Rundown

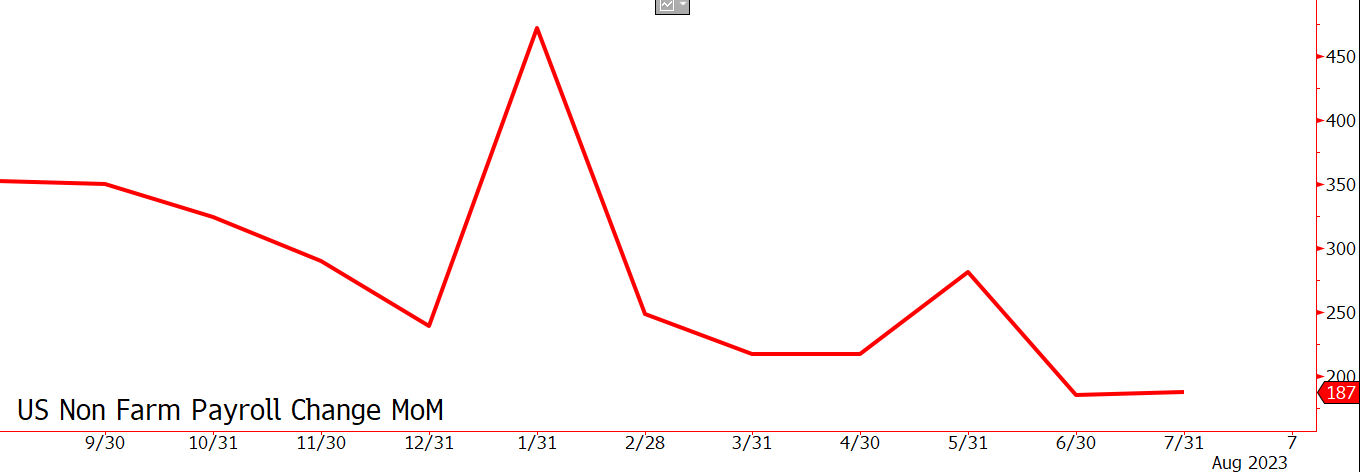

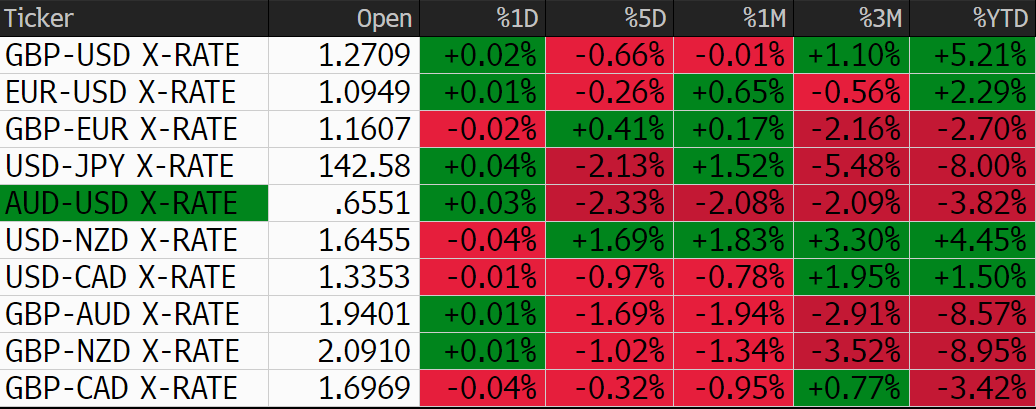

- USD has volatile Friday as US Non-Farm Payroll figure suggested the economy only adding 187,000 jobs in July

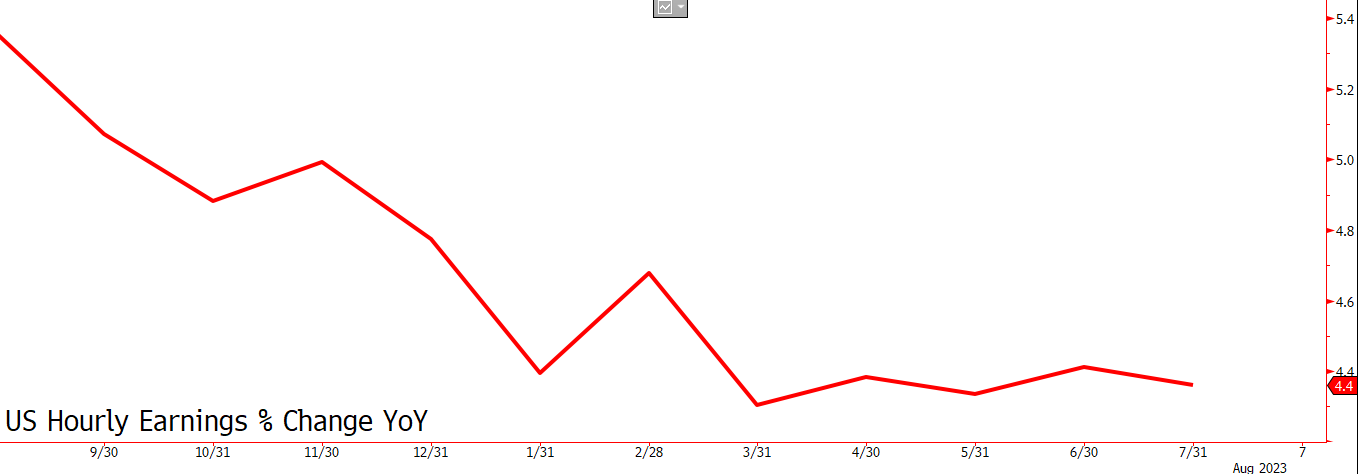

- Wage inflation rises, whilst unemployment drops to 3.5%e

- Inflation figures releasing later in the Week could see further USD weakness

USD-

The Non-Farm payroll release is always one of the most key events in a month, well, from a markets stand point at least! And this months figures giving insight into the condition of the US labour market n July did not disappoint. Overall, 187,000 new jobs were added, below trend but don't let that mislead you.

The overall figure was below that 200k key psychological level yes, but the US already had a very low 3.6% unemployment rate, that also fell to 3.5%. At a certain point an economy simply runs out of people to perform new jobs and that's likely to happen if unemployment is still at a 1969 low.

Wage growth remained stubborn, unchanged at 4.4% average hourly wage growth YoY, suggesting that the US jobs market remains to be a, if not the, most aggressive and unresolved aspect of US inflation.)

In terms of its impact on the Fed, the release was to middling to change any minds, the jobs figure is down, but so is unemployment, to a multi-decade low. Wage growth is high and resilient, but officials will want to wait for the full inflation release on Thursday before committing to a position.

Today's Economic Calendar

-12:00 No Major Releases

Markets This Morning

Rates correct as of 7:30am GMT

-----------------------------------------------------------------------------

What can we expect from financial and currency markets in 2023? Sign up for the latest information delivered to your inbox straight from Caxton Currency Analysts.

- The key themes to look out for in 2023

- How these may impact key currencies

- Wider economic considerations

- Key economic dates in 2023

- Currency forecasts for G10